Century Capital Q1 Market Report

Executive Summary

By Paul Munford, CEO of Century Capital

Despite a tumultuous political and economic backdrop, fluctuating rates, and contradictory market predictions, the first quarter of 2024 has brought huge success to Century Capital. We successfully maneuvered a complex £17.2 million deal on a £30 million property in Marylebone – one of our largest to date. Our total loan volume for this quarter increased by 85% compared to December 2023, and our largest loan size also experienced significant growth.

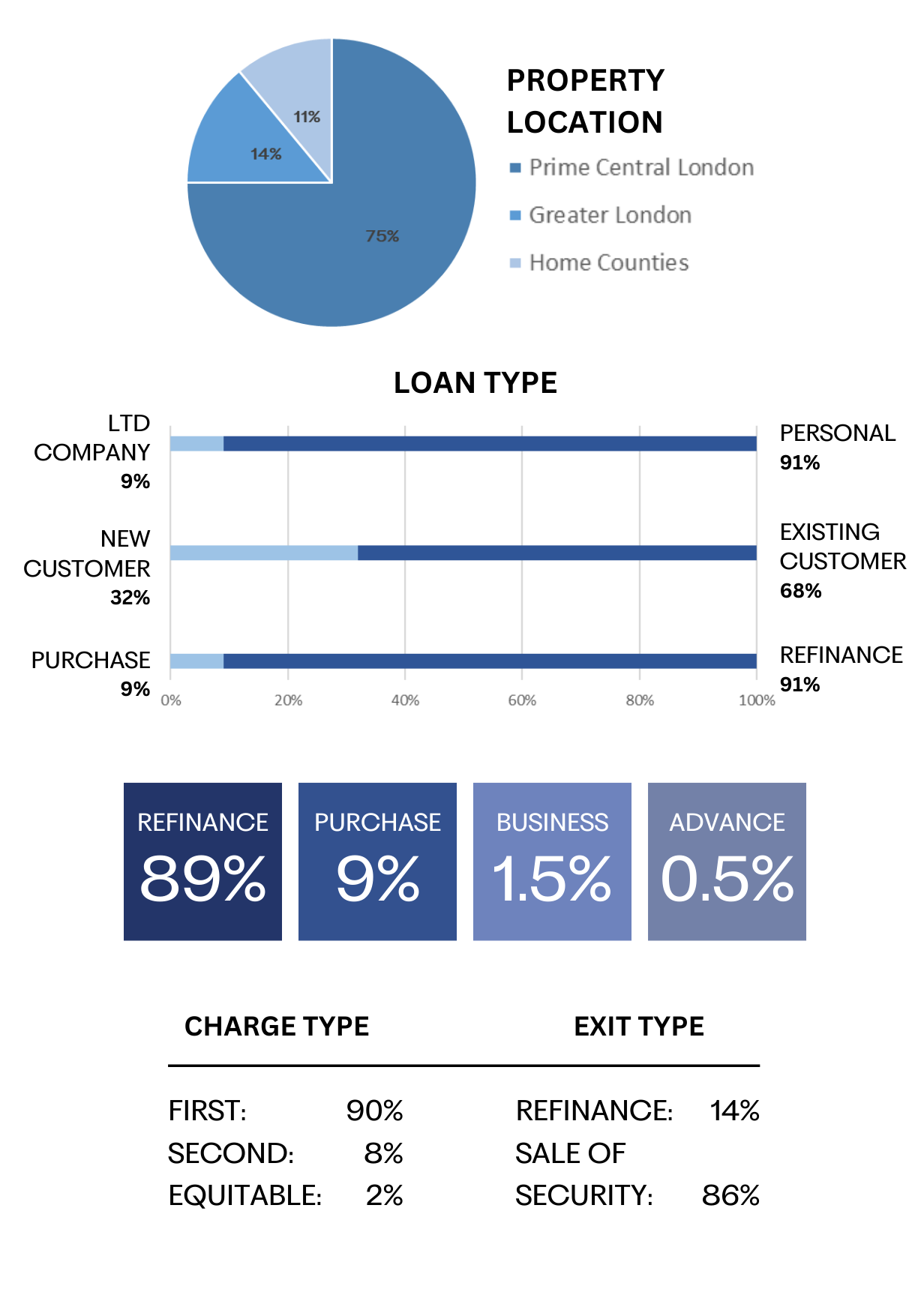

Our strategy for encouraging returning clientele has resulted in 68% of our deals being completed for existing customers, cementing our position as the go-to lender for returning clients in the sector. Moreover, 75% of our completions were secured against assets in Prime Central London, reinforcing Prime Central London as our stronghold.

Aside from deal completions, Century Capital had a busy quarter behind the scenes. Notably, we hosted yet another successful Breakfast Briefing at The Arts Club. Renowned property speaker Russell Quirk moderated a panel of three esteemed speakers: Rupert Collingwood, William Lloyd-Hayward, and our very own Head of Lending, Luke Navin. The panelists navigated their way through a range of topical subjects, including the impact of a potential Labour government on the Prime London property sector, interest rates, house prices, and market trends across London. The event was regarded as a ‘gathering of the great and good’ of the property finance sector, bringing together prominent figures from the industry, including brokers, valuers, underwriters and lenders.

Myself and Century Capital were also featured as ‘top recommended’ on the annual Spear’s 500 Index, an exclusive compilation of the best advisors for high-net-worth individuals in the property industry. To be recognised as one of the top lenders in the industry is truly an honor, and reflects our commitment to excellence in the field.

Finally, this quarter has been one of remarkable growth for Century Capital, with five new additions to the team since January. Our newest employee, Gary Clark, has joined as Sales Director. With his 20 years of experience and vast network, Gary is sure to bring in multiple new business streams, ensuring yet another successful quarter.

Market Insights

By Luke Navin, Head of Lending at Century Capital

The first quarter of 2024 has been an interesting one for the property industry. Yet again, the mayhem and decline forecast by industry experts failed to materialise. With mortgage and swap rates constantly fluctuating, the sector requires some much-needed stability. In spite of this, however, there is a tentative optimism that appears to be gradually spreading throughout the industry, which is even more pronounced following the Monetary Policy Committee’s latest base rate announcement. Although the base interest rate remained once again at 5.25%, the rate of inflation falling to 3.2% in March provides hope that a drop in the base rate will soon follow.

In light of this positive sentiment, we should be wary of an immediate and sharp decrease in interest rates, avoiding a knee-jerk reaction that would potentially cause the economy to spiral again. It seems the MPC is of a similar mind, with an approach that some have deemed ‘overly cautious.’ While we anticipate a gradual decline in rates as summer approaches, it’s improbable that we’ll return to sub-2% interest rates anytime soon. This isn’t necessarily a bad thing, as prolonged periods of low interest rates can lead to an accumulation of unsustainable debt within the market, leading to even more instability.

In other news, the annual Spring Budget announcement signals several shifts in the property sector, although perhaps not as many as anticipated. There is uncertainty surrounding the non-dom tax reforms and their impact on high-net-worth clients. The Chancellor also announced that the higher rate of Capital Gains Tax would be reduced from 28% to 24%, motivating high-net-worth and asset-rich individuals to dispose of their buy-to-let properties sooner, stimulating the residential property market. The Chancellor has similarly reduced the annual exemption from £6,000 to £3,000, down from £12,300 in 2022/23.

As the discussion intensifies around this year’s general election, so too does the conversation regarding the political influence of a Labour government on the prime property finance sector, particularly given the high likelihood of a transition from a Conservative to Labour government. It will be interesting to see how political parties incorporate property market dynamics into their campaign strategies, and whether any of their promises will be mobilised to enact actual meaningful change.

January’s Featured Deals:

1.Mayfair Townhouse

Lon Amount: £4.7 million

Property Value: £6.5 million

LTV: 72%

This Mayfair Georgian townhouse, features a Juliet balcony, en-suite bathrooms and has been refurbished with a grand traditional style. The borrower is an ultra high-net-worth individual, worth approximately £50 million. They required a fast solution, and came to Century Capital having heard of our speed and agility.

Property USPs:

- Freehold

- Excellent location, with amenities in close proximity

- Refurbished to a high standard

- Air conditioning

- Staff flat

2. Chelsea Property:

Loan Amount: £4.9 million

Property Value: £7 million

LTV: 70%

Located in the heart of Chelsea, this five-storey, four-bedroom, mid-terraced Victorian property boasts a number of incredible features, including two patios and a beautifully refurbished balcony. With the borrower being LA based, the overseas bank brought in Century Capital to secure time to enable the sale.

Property USPs

- Located on a popular street in Chelsea

- Close to the amenities of Kings Road

- Freehold

- Refurbished to a high standard

- Fully extended

February’s Featured Deals:

3. Hackney Mews:

Loan Amount: £2,775,000

Property Value: £4,150,000

LTV: 67%

The £2.7 million loan was secured against two converted warehouse properties located in the creative East London hub of Hackney. They were meticulously transformed by the borrower into two stunning semi-detached 3-bedroom mews houses, boasting a contemporary industrial aesthetic. Both properties have impressive high vaulted ceilings beneath bespoke domed roofs, along with access to a rooftop terrace. The borrower, an experienced developer, turned to Century Capital when his previous lender was unable to provide further refinancing.

Property USPs:

- Newly built properties finished to a good standard

- Desirable location in a trendy neighbourhood

- Well proportioned – 3 bedrooms and 3 bathrooms

- Unique high vaulted ceilings and domed roofs with roof access

4. Chelsea Townhouse:

Loan Amount: £795,000

Property Value: £8,750,000

Second Charge

The loan was secured against a mid-terrace, post war Chelsea townhouse with highly sought-after features including a gym, cinema room, terrace and garage. The borrower, a high-net-worth businessman, is a returning Century Capital client who sought a second charge loan to acquire a London property. With his income tied up in offshore streams, he required a tailored financing solution to navigate these complexities.

Property USPs

- Good amenities and features

- Leasehold garage

- Refurbished to an excellent standard by an award-winning designer

- Freehold

March’s Featured Deals:

5. Marylebone Mansion:

Loan Amount: £17,200,000

Property Value: £29,000,000

LTV: 58%

Century Capital lent a £17.2 million first charge loan against this Georgian gem, located in one of the most coveted neighbourhoods in London. This exquisite Grade II listed home spans an impressive 12,000 square feet across five floors. It boasts a charming courtyard garden, grand high ceilings, and exclusive access to Regents Park. The client, a repeat borrower, is a hugely influential figure in the fashion industry. Incidentally, the property itself is also a prominent image in popular culture, featuring as the backdrop of several films and photoshoots.

Property USPs:

- Highly sought after residential area, with period buildings

- Close proximity to the West End and transport links

- Impressive cantilevered staircase beneath a vaulted 3m glass dome

6. Oxford Portfolio:

Loan Amount: £2,880,000

Property Value: £4,340,000

LTV: 66%

The loan was secured for three shareholders, to fund the acquisition of a property portfolio in Oxford. The portfolio comprises of 7 residential units and 1 commercial property. It consists of a multitude of property types at different valuations, ranging from a quaint 1 bed flat to a 6 bed HMO.

Property USPs:

- Established residential location with strong rental market

- Diversified portfolio mix offers different exit strategies

- Assets can be sold individually

©2023 Copyright Century Capital. All Rights Reserved.